whether such relationship precludes a finding of independence in the Board’s business judgment. The Board considered the following relationships in its evaluation of the independence of ournon-management directors.

The NYSE Rules provide that a director cannot be independent if he or she is a current employee, or a member of his or her immediate family is a current executive officer of another company that has made payments to, or received payments from, ProAssurance during the past three (3) years in an amount that exceeds the greater of $1 million or two percent (2%) of thatthe other company’s consolidated gross revenues during each fiscal year ended in such period.

Anthony R. Tersigni, EdD, FACHE is the President and Chief Executive officer of Ascension Health Alliance or Ascension. Ascension is the parent holding company for Ascension Health (“AH”) and Ascension Health Insurance, Ltd. (“AHIL”). Ziad R. Haydar, M.D. is Senior Vice President and Chief Clinical Officer of AH. Effective January 1, 2011, ProAssurance entered into a Program Agreement with AH (the “Program”) pursuant to which a branded joint insurance program was created to insure the professional liability of certain physicians and healthcare providers affiliated with the Ascension health system, which is comprised of over 100 non-profit hospitals and other healthcare providers (the “System”). The Program, marketed under the name “Certitude®,” is administered and underwritten by ProAssurance’s insurance subsidiaries. Policies issued under the Program are reinsured by AHIL. In 2013, 2014 and 2015, ProAssurance’s insurance subsidiaries wrote premiums through the Program in the amount of $22,427,745, $25,775,624 and $30,781,333 respectively, of which $5,136,372, $8,002,392 and $8,489,894 respectively, was paid by Ascension affiliates on behalf of the physicians. ProAssurance paid a reinsurance premium to AHIL in the amount of $12,089,305 in 2013, $14,390,619 in 2014, and $16,323,034 in 2015, and AHIL paid to ProAssurance a ceding commission of $1,905,981 in 2013, $1,938,507 in 2014, and $2,177,930 in 2015. In 2015, AHIL also paid a subsidiary of ProAssurance a ceded premium of $483,431 under a reinsurance treaty that provides a buffer layer for excess professional liability insurance written by AHIL. The Board found that Dr. Haydar is not precluded from being independent because the amount of payments to and from ProAssurance was significantly below the two percent (2%) of the consolidated revenues of Ascension and thereby did not meet the “bright line” tests for independence under the NYSE Rules. Furthermore, the Board found that Dr. Haydar is not precluded from being independent

7

under the Governance Guidelines, which prohibit any material transaction relationship using the same thresholds applied solely to the recipient of the payments, because the payments actually made by Ascension on behalf of physicians and providers are less than 2% of our revenues in 2015. Based on these determinations, the Board found Dr. Haydar to be an independent director.

Frank A. Spinosa, D.P.M., is a member of the Board of Trustees of the American Podiatric Medical Association (the “Association”) and served as its President for the year that ended March 23, 2015. Dr. Spinosa is not and has not been an employee of the Association, but he received an honorarium in the amount of $159,500 for his services as President of the Association, all of which was paid in 2014. The Association and ProAssurance’s subsidiary, Podiatry Insurance Company of America (“PICA”), are parties to a License Agreement effective March 1, 2011 (the “License Agreement”), pursuant to which PICA is required to pay the Association $100,000 per annum for the Association’s endorsement of PICA’s medical professional liability insurance and for the right to use the Association’s name, logo and member list in marketing the endorsed products. PICA has also agreed to pay at least $25,000 per annum in support of the Annual Scientific Meeting; to provide a PICA Risk Management Program at such meeting; and to provide a premium discount to PICA insured podiatric physicians who attend the Risk Management Program. Finally, PICA has agreed to support the Association’s Young Member Program at the rate of $174,000 per annum. In 2013, 2014 and 2015, PICA paid the Association $446,250, $505,175 and $290,000 respectively, pursuant to the License Agreement and as miscellaneous donations. The current budget for the Association contemplates annual revenues of approximately $13.8 million. Based on these amounts, the Board found that Dr. Spinosa was not precluded from being independent under NYSE Rules because the payments to and from ProAssurance in the last three years were below the threshold of $1,000,000. Furthermore, the Board found that Dr. Spinosa is not precluded from being independent based on its understanding of the Governance Guidelines, which prohibit any material transaction relationship using the same thresholds applied solely to the recipient of the payments. In addition, we have had discussions with ISS about these payments to the Association and their historical context and importance to the business of PICA, and we were advised that ISS considers these payments transactional in nature so that they should not preclude a finding that Dr. Spinosa is independent.

Three of our directors have purchased medical professional liability insurance from the Company either directly or indirectly through their respective practice entities during the last three years (Drs. Listwan, Spinosa, Vance, and Wilson), and. Dr. Spinosa’s spouse is a physician insured by the Company. Dr. Listwan purchased insurance from the Company until December 31, 2013, and he paid premiums of less than $3,000 in 2013. Dr. Spinosa and his spouse have purchased individual policies of medical professional liability insurance from PICAan insurance subsidiary of ProAssurance during the last three years as follows: 2013-20142017-2018 — $3,379;2018-2019 —$1,232; and 2019-2020 — $2,042. Dr. Spinosa $5,052 and spouse $7,352; 2014-2015 — Dr. Spinosa $8,024 and spouse $7,978; 2015-2016 — Dr. Spinosa $8,266 and spouse $8,266. Dr. WilsonVance purchased individual policies of medical professional liability insurance from an insurance subsidiary of ProAssurance in each of the last three years as follows: 2013-20142017-2018 — $47,993; 2014-2015$8,719;2018-2019 — $47,993; $8,305; and 2015-20162019-2020 — $42, 274.$8,318. Dr. WilsonVance is also an executive officera partner of Neurosurgical Associates, P.C.,Alabama Oncology, which is insured by one of ProAssurance’s insurance subsidiaries with a current premium of approximately $134,383.$260,761. Dr. Wilson, who retired in July 2019, purchased individual policies of medical professional liability insurance from an insurance subsidiary of ProAssurance in the two years prior to his retirement as follows:2017-2018 —$33,350; and2018-2019 — $33,350. Dr. Wilson was also an executive officer of Neurosurgical Associates, P.C. until his retirement, which is insured by one of ProAssurance’s insurance subsidiaries with a current premium of approximately $119,029. All insurance policies were obtained in the ordinary course of business at rates that are consistent with our filed rates and customary underwriting practices. The premiums paid with respect to the individual physicians or the practice entities do not exceed the lower $1,000,000 standard of materiality set forth in the NYSE Rules.Rules and Governance Guidelines.

Our Board has consistently found that it is customary and appropriate for our physician directors to obtain their professional liability insurance from our insurance subsidiaries, and that the purchase of insurance from our subsidiaries will not impair the independence of a director so long as the premiums paid are less than the $1,000,000 limitation in the NYSE Rules. In addition, the Board determined that the purchase of insurance did not create any material interest in the transaction such that it would have an effect on the independence of a director. For this reason, the Board also determined that the purchase of insurance should not be considered a “material relationship” based on our understanding of the Governance Guidelines since it does not influence these directors’ objectivity in a manner that would impair their ability to satisfy fiduciary standards.

Mr. Gorrie is the President and Chief Executive Officer of Brasfield & Gorrie, Inc. (“B&G”). B&G is a controlling member of Hangar 24, LLC (“Hangar 24”) of which ProAssurance owns 20% and B&G owns 60%.

8

The sole purpose of Hangar 24 is to share the cost of the hangar leased from the Birmingham Airport Authority where ProAssurance keeps its corporate aircraft. Hangar 24 pays the rent on the hangar. ProAssurance reimburses Hangar 24 for its share of the rent and reimburses Hangar 24 for the cost of the fuel used by its aircraft. The Board of Directors determined that this relationship did not preclude Mr. Gorrie’s independence because the amounts paid for rent and fuel reimbursement do not exceed the greater of $1,000,000 or 2% of the recipient’s gross revenues and it does not meet the materiality threshold for “material transactions” under the Governance Guidelines.

Mr. McMahon is an executive officer and a controlling stockholder of Ligon Industries (“Ligon”). Ligon and ProAssurance (through their subsidiaries) are parties to an Aircraft Interchange Agreement dated April 5, 2012. Pursuant to this agreement, ProAssurance has the right to use the Ligon aircraft at its election on the condition that ProAssurance allows Ligon to use the ProAssurance aircraft for the same amount of time. The Board of Directors determined that this relationship did not preclude Mr. McMahon’s independence because the value of the exchange between Ligon and ProAssurance did not exceed the greater of $1,000,000 or 2% of the recipient’s gross revenues and it doesdo not meet the materiality threshold for “material transactions” under the Governance Guidelines.

The Board of Directors has determined that the relationship between Ascension and ProAssurance did not impair the independence of either Dr. Tersigni or Dr. Haydar; the relationship between PICA and the American Podiatric Medical Association did not impair the independence of Dr. Spinosa; that the purchase of medical professional liability insurance by our directors and their relatives did not impair the independence of Drs. Listwan, Spinosa, Vance, and Wilson; and that the relationship between ProAssurance and B&G did not impair the independence of Mr. Gorrie; and that the relationship between ProAssurance and Ligon did not impair the independenceGorrie.

Relationships Considered for Independence of Mr. McMahon.

The NYSE rules provide that a director cannot be independent if he or she, or an immediate family member of such director, has received compensation (other than director and committee compensation) during any 12-month period of more than $120,000 from, ProAssurance or any of its subsidiaries in any of the last three years.Committee Members.

Dr. Spinosa’s spouse has served on the physicians’ committee of PICA and received compensation and reimbursement of expenses from PICA in the following amounts during the last three years: 2013 — $14,215 (including $4,751 for reimbursement of expenses), 2014 — $15,548 (including $5,648 for reimbursement of expenses), and 2015 — $3,648 (including $2,148 reimbursement of expenses). Dr. Spinosa did not receive any compensation from PICA or any other subsidiary of ProAssurance during this period. The Board determined that the payments to Dr. Spinosa’s spouse did not impair his independence because the amount of the fees did not exceed the $120,000 threshold and because his spouse is not dependent on PICA for her primary source of compensation. The Board also determined that payments made to Dr. Spinosa’s spouse in 2015 should not violate the Governance Guidelines which prohibit compensation for “professional services” in excess of $10,000 per year to a director’s spouse.

We have engaged Dr. Listwan as a consultant under a Consulting and Confidentiality Agreement that provides that Dr. Listwan will provide nonexclusive services to ProAssurance relating to review of insurance cases, facilitating ProAssurance’s relationship with the Wisconsin Medical Society, providing consultation services with respect to claims, underwriting, and risk management, and providing other services as requested in consideration of an annual retainer of $44,000. At its meeting on December 2, 2015, the Board of Directors reviewed this consulting arrangement and determined that Dr. Listwan satisfies the current independence criteria for directors because: (i) Dr. Listwan is not an employee of ProAssurance or any of its subsidiaries based on the Board’s review of the terms of Dr. Listwan’s engagement as a consultant and its consideration of Internal Revenue Service regulations defining employees and independent contractors for purposes of FICA (Federal Insurance Contributions Act) withholding, and the factors used by our Human Resources Department to determine whether a service provider receives a statement on Form W-2 (an employee) or Form 1099 (independent contractor) with respect to its compensation for services; and (ii) the compensation payable to Dr. Listwan for services as a consultant would not exceed the limitation on non-director compensation under the NYSE Rules. Based on the above analysis, the Board of Directors determined that Dr. Listwan should be

9

considered an independent director under the NYSE Rules notwithstanding the Governance Guidelines, which provide that a director will be deemed an “Affiliated Outside Director” if he or she receives compensation in excess of $10,000 for “professional services.”

The Board of Directors has determined that the payment of consulting fees to Dr. Spinosa’s spouse and Dr. Listwan should not impair the independence of Drs. Spinosa and Listwan.

Other Relationships Considered.

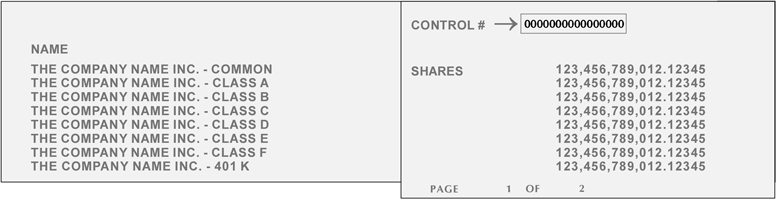

The Board of Directors evaluated the independence of the members on both the Audit Committee and Compensation Committee. Mr. Adkins, Mr. Angiolillo, Mr. Di Piazza’sPiazza, and Dr. Putallaz’sSpinosa serve on the Audit Committee. Mr. Adkins’ and Mr. Di Piazza’s only relationship with the Company is their service on the Board

8

(located on the following page) and visit:

(located on the following page) and visit: (located on the following page) in the subject line.

(located on the following page) in the subject line.

available and follow the instructions.

available and follow the instructions.